Some Known Questions About Forex Spread Betting.

Wiki Article

5 Easy Facts About Forex Spread Betting Explained

Table of ContentsNot known Details About Forex Spread Betting Some Known Factual Statements About Forex Spread Betting Getting My Forex Spread Betting To WorkSome Ideas on Forex Spread Betting You Need To KnowNot known Facts About Forex Spread BettingThe Main Principles Of Forex Spread Betting Not known Facts About Forex Spread Betting

They supply reasonably tight spreads however undergo overnight funding. This is a cost that you pay to hold a trading position overnight on leveraged professions. It is efficiently a rate of interest settlement to cover the expense of the take advantage of that you are using. Daily moneyed bets are typically used for short-term settings due to the impact of these overnight fees.

75. You make a decision to bet 10 per point. The share price does certainly rally, to 170. 75 cent, as well as you decide to shut your position to take your revenue. Once more, a one-point spread applies, so the sell price is 170 (forex spread betting). 25. The marketplace has actually relocated your favour by 19.

The Main Principles Of Forex Spread Betting

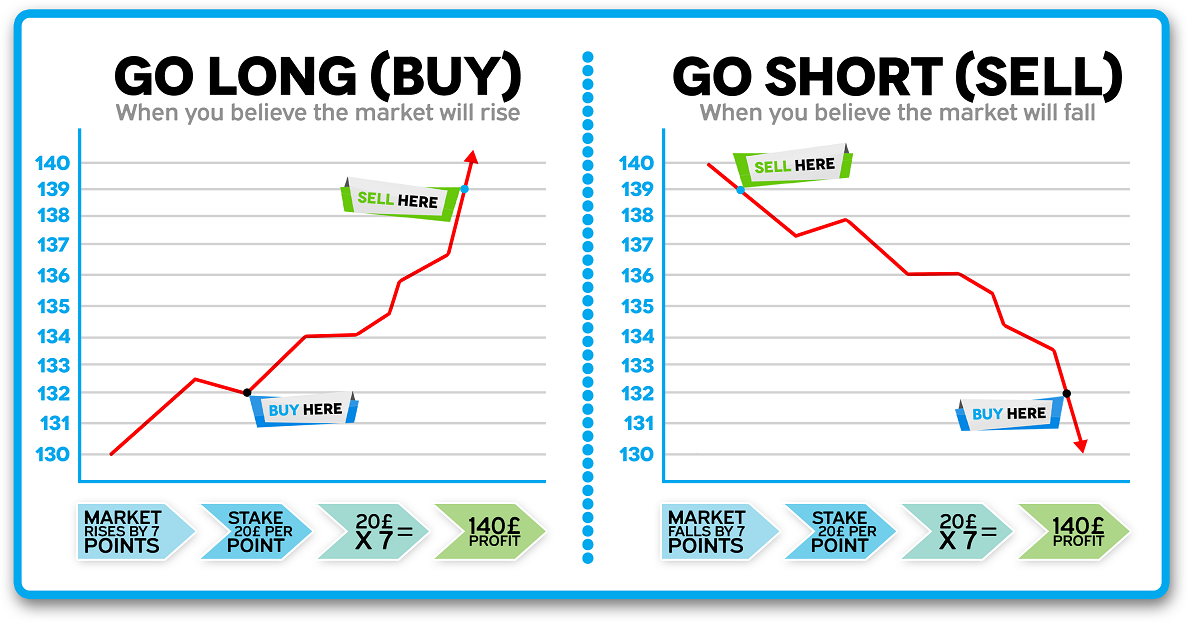

As we have seen, among the benefits of spread wagering is that you can magnify the effect of your wager via utilize. Simply put, you just require to deposit a tiny portion of the general worth of any type of profession. This is called the margin. If the margin need for a trade is 20 per cent, then you would just need 20 per cent of the complete value of the profession in your account to open up the position., which discusses how utilize functions when you spread out wager on supplies. The very same principles apply to all other economic tools that you spread wager on.

You determine to get 1000 shares in ABC plc at a rate of 5 each in the idea that the business's profits will rise. If you simply got the shares directly on the supply market, the overall expense would be 5000 (1000 shares x 5 per share). You can attain the same exposure by taking out a spread wager of 10 per point on the exact same business, and also you would just have to offer a down payment, or margin, of 1000 since the broker is using you utilize of 5:1.

The 20-Second Trick For Forex Spread Betting

You must constantly see to it the funds in your account suffice to cover any kind of losses from existing professions. Otherwise, there is a threat that the broker might merely shut your placements, leaving you with losses. The benefits of spread wagering consist of: There is no stamp task to pay, as well as any type of revenues you make are tax-free. forex spread betting.

It is very simple to trade via an online broker, either in your house or on the go. You can bet that the price of a tool will certainly climb or drop.

All About Forex Spread Betting

Spread wagering on shares gives capitalists no entitlement to dividends or the various other civil liberties delighted in by shareholders. By contrast, with spread betting you can lose two, 3 or even 10 times your original stake within a few mins as a repercussion of utilize.Although utilize indicates you can trade a huge amount with check here a reasonably small sum, spread wagering can be surprisingly prime extensive. That is since you constantly need to keep a big amount on book to cover any type of losses and stay clear of a margin telephone call or, worse still, have the broker close your account.

While this develops lucrative possibilities, it can also confirm harmful, with rates relocating dramatically in either instructions. You are getting in right into an agreement with the broker and also there is always the threat that the various other party to the contract could go bust or, in the case of an uncontrolled broker, merely renege on the offer.

An Unbiased View of Forex Spread Betting

Both make usage of leverage and also allow investors to profit from motions in the rates of a wide variety of economic instruments. You can utilize either spread betting or CFDs to bet that an item will climb or drop in value. The crucial distinction in between the two items is that make money from spread betting are devoid of tax, while make money from CFDs undergo capital gains tax in the UK.On top of that, while you do not pay a payment on spread betting, brokers may charge a commission to sell CFDs. Provided the risks associated with spread wagering, it is vital that you know the actions you can require to alleviate any type of losses. You can secure against the risk of losing greater than your deposit in a trade by setting an automatic quit, or limit, to define the level at which you would certainly like your trade to be shut.

Spread betting on shares grants capitalists no entitlement to dividends or the other civil liberties appreciated by investors. By contrast, with spread wagering you can shed 2, 3 or also 10 times your original stake within a couple of minutes as a consequence of utilize.

All about Forex Spread Betting

Although leverage suggests you can trade a large amount with a relatively tiny sum, spread wagering can be remarkably prime intensive. That is since you always need to keep a big amount on reserve to cover any losses and also stay clear of a margin phone call or, even worse still, have the broker close your account.Spread-betting markets can Click This Link be very unstable. While this develops profitable possibilities, it can also prove dangerous, with costs moving dramatically in either site web direction. This can lead to substantial losses amassing over a short period. You are entering into a contract with the broker and there is constantly the danger that the other event to the contract can fail or, in the situation of an uncontrolled broker, simply renege on the deal.

Getting The Forex Spread Betting To Work

Furthermore, while you do not pay a commission on spread betting, brokers might charge a compensation to sell CFDs. Offered the dangers associated with spread betting, it is vital that you know the procedures you can take to reduce any type of losses. You can secure against the risk of shedding more than your down payment in a trade by setting an automated quit, or limitation, to specify the degree at which you would like your trade to be closed.Report this wiki page